And so I’m house-hunting again, this time very determined to buy a place for myself. This is the second time I’m trying to buy something here: I visited a few properties to invest back in 2009, but dropped my investigation when the market started to rebound in the most brutal way. Unlike locals I’m mostly looking at the secondary market as I want something now, not in 3 years. And once again I’m facing one of the worst plague of Singapore’s real-estate market: fake sellers.

Continue reading Why a property for sale is not for sale

Category: Real Estate

Bubble, what bubble?

Just like in the good old days, Channel NewsAsia has a report on people being paid to queue overnight at a new property launch. The real-estate bubble in Singapore is still alive and kicking despite the government measures to cool it down, a sagging stock market and gloomy economic outlook.

Singapore’s Q1 Real Estate Look

So it’s another quarter and another bunch of real-estate numbers that look pretty much the same as six month ago. The same observations stay true: non-landed is up but slowing down, landed properties are however still skyrocketing. This can’t end well…

Continue reading Singapore’s Q1 Real Estate Look

Real-estate as an alternative to gold?

Inflation is back on the radar, and the world economy is still a bit wobbly with quantitative easing here and sovereign debt crisis there, so it’s no wonder some investors worry about not loosing their shirt and turn to gold as not just a new bubble to ride but as a form of wealth protection. Being a “hard asset”, real-estate can also be seen as a form of wealth protection: after all, no matter how bad the economy gets, a house remains a house (well, assuming property laws are still enforced, which historically hasn’t always been the case). It has often been argued that the Chinese real-estate bubble is caused by local investors trying to preserve their capital from high inflation and who lack other investment alternatives, could it be the case in other countries as well ? Continue reading Real-estate as an alternative to gold?

Q3 Singapore’s Real Estate Update

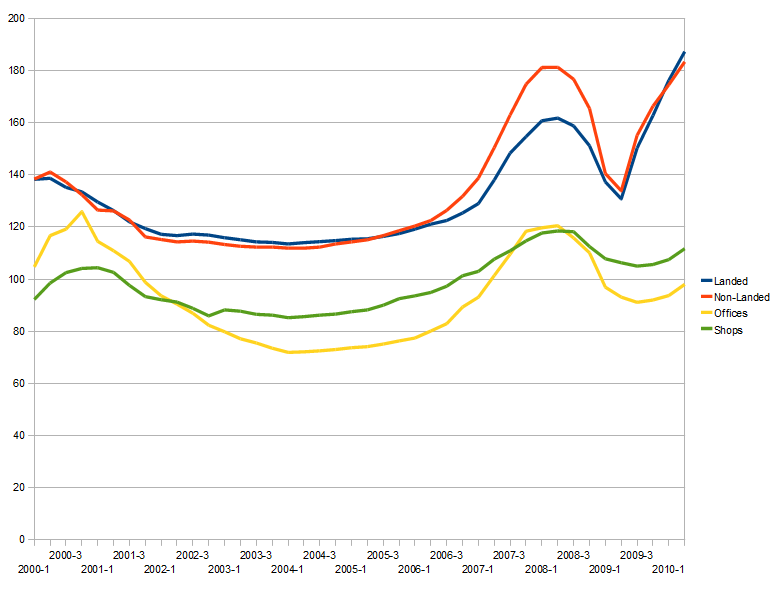

As URA has released definitive Q3 prices for Singapore’s real estate market, I’m posting a quick updated graphic. This is interesting as it will show the effect (or lack of) the governement’s latest cooling measures.

A few notable things:

- Non-Landed prices are loosing steam, although still growing

- Landed prices are shooting to the moon and breaking new records

- Office and commercial seem to follow a very regular cyclical pattern (yawn!)

A first look at Singapore’s real estate market

Let me start this article by diving right in and showing you the real estate prices in Singapore, quarter by quarter, as collected by the Urban Redevelopment Authority.

Pretty interesting right? Back in July 2009 I was actually thinking of buying a property there to take advantage of the prices finally going down. After a handful of visits I had to give up: things were becoming way too crazy for me. Prices would suddenly go up between the moment the ads were posted and the moment I would set a foot in the property for a visit. In one instance where I was trying to negotiate a condominium unit, the seller decided to raise his original asking price, rather than lower it to reach me halfway as you would expect in any negotiation. For the record, that property still hasn’t sold one year later, but the price has been raised again…

Pretty interesting right? Back in July 2009 I was actually thinking of buying a property there to take advantage of the prices finally going down. After a handful of visits I had to give up: things were becoming way too crazy for me. Prices would suddenly go up between the moment the ads were posted and the moment I would set a foot in the property for a visit. In one instance where I was trying to negotiate a condominium unit, the seller decided to raise his original asking price, rather than lower it to reach me halfway as you would expect in any negotiation. For the record, that property still hasn’t sold one year later, but the price has been raised again…

Continue reading A first look at Singapore’s real estate market